Marischal Square, Aberdeen - Former Resident X

Units C & E,

Marischal Square,

Broad Street,

AB10 1AS

Rental Offers

£

Type

Restaurants

City

Aberdeen

Tenure

Leasehold

Request an Appointment

-

Description

LOCATION

Aberdeen is Scotland’s third largest city and has a thriving job market based around oil and gas, bioscience and tourism with a low unemployment rate. The city has a population of approximately 220,000 and wider catchment of approximately 500,000.

The city is home to two top two universities, the University of Aberdeen and Robert Gordon University and there is a vibrant retail and entertainment culture. The estimated student population is 30,000.

The immediate surrounding area includes tourist attractions Marischal College, Aberdeen Art Gallery and Union Terrace Gardens, making this a highly regarded location at the heart of the city centre for hospitality operators.

DESCRIPTION

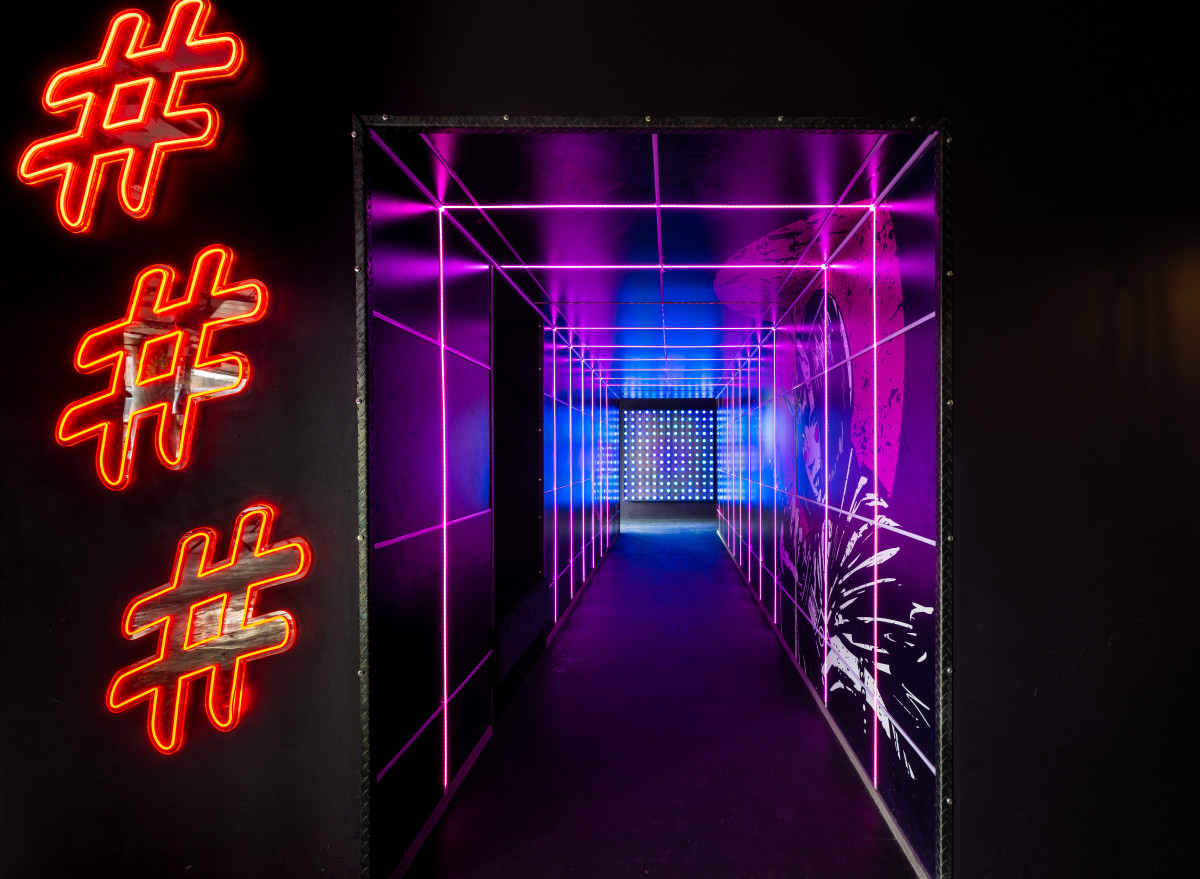

Marischal Square is a new build Grade A office, leisure and hospitality development, completed in 2017, providing over 173,000 sq. ft. of office accommodation and ground floor hospitality venues. Hospitality offers include All Bar One, Costa Coffee, Mackie’s 19.2 and the 126-bedroom four-star Residence Inn by Marriott. Office occupiers include CBRE, EY, KMPG, Royal Bank of Scotland, DC Thomson and Chevron.

The subjects compromise a large ground floor unit with capability of sub-division, with prominent visibility from the Bon Accord Centre.

Currently set our as follows

- 2 bars.

- 4 street food kitchens

- Large kitchen

- Seating area

- Stores

- Toilets

COURTYARD

The unit benefits from the ability for an area of demised external seating in the courtyard, with the ability to use a larger area of the courtyard for occasional events subject to agreement with the landlord.

ACCOMMODATION

The Gross Internal Floor areas have been calculated in accordance with the RICS Code of Measuring Practice (6th Edition). All at Ground floor level.

DESCRIPTION SQ. M. SQ. FT. Units C & E 942 10,047 There is potential to sub-divide the units into 2 or 3 smaller units

ENERGY PERFORMANCE CERTIFICATE (EPC)

Subject currently benefits from ratings ranging from E to D. Full documentation is available on request.

PREMISES LICENCE

There is a premises licence in place which operates between the following hours:

Monday – Thursday: 11:00 – 02:00

Friday/Saturday: 12:00 – 03:00

Sunday: 12:00 – 02:00

A new operator can request alterations to operating hours to suit their operating hours.

SERVICES

We understand that the premises are connected to all mains services, including water, electricity, gas and drainage. There is a space heating / cooling system and extract from the Kitchen. business model.

LEASE TERM

Rental offers are sought for a new lease over either the combined unit or a sub-division of the units for a period to be negotiated. Any medium to long term lease term will incorporate rent reviews at 5 yearly intervals. Further information on rental can be discussed with the joint letting agents.

SERVICE CHARGE

There is a service charge payable for the upkeep, repair and maintenance of the common parts of the building in the region of c.£20,000 per annum (c.£2.00 per sq ft). Further information can be provided to interested parties on request.

RATEABLE VALUE

The subjects have a combined Rateable Value of £155,000 per annum effective from 1st April 2023. This equates to a rates payable of c.£87,000 per annum. A new occupier will have the right to appeal the Rateable Value.

VAT

All figures are exclusive of VAT, which will be payable at the prevailing rate.

DATE OF ENTRY

Immediate upon conclusion of legal missives.

LEGAL COSTS

Each party will be responsible for their own legal costs incurred in documenting a transaction. The ingoing occupier will be responsible for any LBTT and Registration Dues, if applicable.

ANTI-MONEY LAUNDERING (AML)

The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 came into force on the 26th June 2017. This now requires us to conduce due diligence on property purchasers. Once an offer has been accepted, the prospective purchaser(s) will need to provide, as a minimum, proof of identity and residence.

-

Floor Plans

There are no property floorplans available

-

Dataroom

There are no property datarooms available

-

Description

LOCATION

Aberdeen is Scotland’s third largest city and has a thriving job market based around oil and gas, bioscience and tourism with a low unemployment rate. The city has a population of approximately 220,000 and wider catchment of approximately 500,000.

The city is home to two top two universities, the University of Aberdeen and Robert Gordon University and there is a vibrant retail and entertainment culture. The estimated student population is 30,000.

The immediate surrounding area includes tourist attractions Marischal College, Aberdeen Art Gallery and Union Terrace Gardens, making this a highly regarded location at the heart of the city centre for hospitality operators.

DESCRIPTION

Marischal Square is a new build Grade A office, leisure and hospitality development, completed in 2017, providing over 173,000 sq. ft. of office accommodation and ground floor hospitality venues. Hospitality offers include All Bar One, Costa Coffee, Mackie’s 19.2 and the 126-bedroom four-star Residence Inn by Marriott. Office occupiers include CBRE, EY, KMPG, Royal Bank of Scotland, DC Thomson and Chevron.

The subjects compromise a large ground floor unit with capability of sub-division, with prominent visibility from the Bon Accord Centre.

Currently set our as follows

- 2 bars.

- 4 street food kitchens

- Large kitchen

- Seating area

- Stores

- Toilets

COURTYARD

The unit benefits from the ability for an area of demised external seating in the courtyard, with the ability to use a larger area of the courtyard for occasional events subject to agreement with the landlord.

ACCOMMODATION

The Gross Internal Floor areas have been calculated in accordance with the RICS Code of Measuring Practice (6th Edition). All at Ground floor level.

DESCRIPTION SQ. M. SQ. FT. Units C & E 942 10,047 There is potential to sub-divide the units into 2 or 3 smaller units

ENERGY PERFORMANCE CERTIFICATE (EPC)

Subject currently benefits from ratings ranging from E to D. Full documentation is available on request.

PREMISES LICENCE

There is a premises licence in place which operates between the following hours:

Monday – Thursday: 11:00 – 02:00

Friday/Saturday: 12:00 – 03:00

Sunday: 12:00 – 02:00

A new operator can request alterations to operating hours to suit their operating hours.

SERVICES

We understand that the premises are connected to all mains services, including water, electricity, gas and drainage. There is a space heating / cooling system and extract from the Kitchen. business model.

LEASE TERM

Rental offers are sought for a new lease over either the combined unit or a sub-division of the units for a period to be negotiated. Any medium to long term lease term will incorporate rent reviews at 5 yearly intervals. Further information on rental can be discussed with the joint letting agents.

SERVICE CHARGE

There is a service charge payable for the upkeep, repair and maintenance of the common parts of the building in the region of c.£20,000 per annum (c.£2.00 per sq ft). Further information can be provided to interested parties on request.

RATEABLE VALUE

The subjects have a combined Rateable Value of £155,000 per annum effective from 1st April 2023. This equates to a rates payable of c.£87,000 per annum. A new occupier will have the right to appeal the Rateable Value.

VAT

All figures are exclusive of VAT, which will be payable at the prevailing rate.

DATE OF ENTRY

Immediate upon conclusion of legal missives.

LEGAL COSTS

Each party will be responsible for their own legal costs incurred in documenting a transaction. The ingoing occupier will be responsible for any LBTT and Registration Dues, if applicable.

ANTI-MONEY LAUNDERING (AML)

The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 came into force on the 26th June 2017. This now requires us to conduce due diligence on property purchasers. Once an offer has been accepted, the prospective purchaser(s) will need to provide, as a minimum, proof of identity and residence.

-

Floor Plans

There are no property floorplans available

-

Dataroom

There are no property datarooms available

Designed & built by Mucky Puddle