97 Buchanan Street Glasgow - SOLD

97 Buchanan Street,

G1 3HF

Offers Over

£849,500

Type

Other

City

Glasgow

Tenure

Heritable

Request an Appointment

-

Description

UNDER OFFER

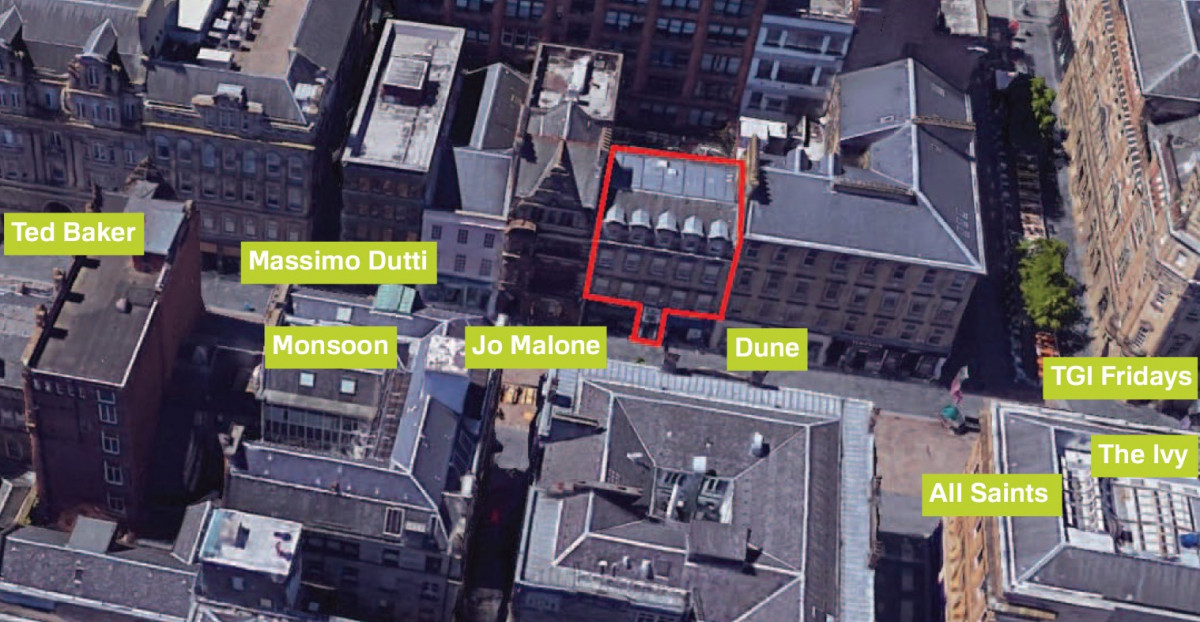

LOCATION

Glasgow is one of the strongest retail locations outside London, attracting 3.2 million visitors spending £2.3 billion, including around 800,000 international tourists (2017 figures).

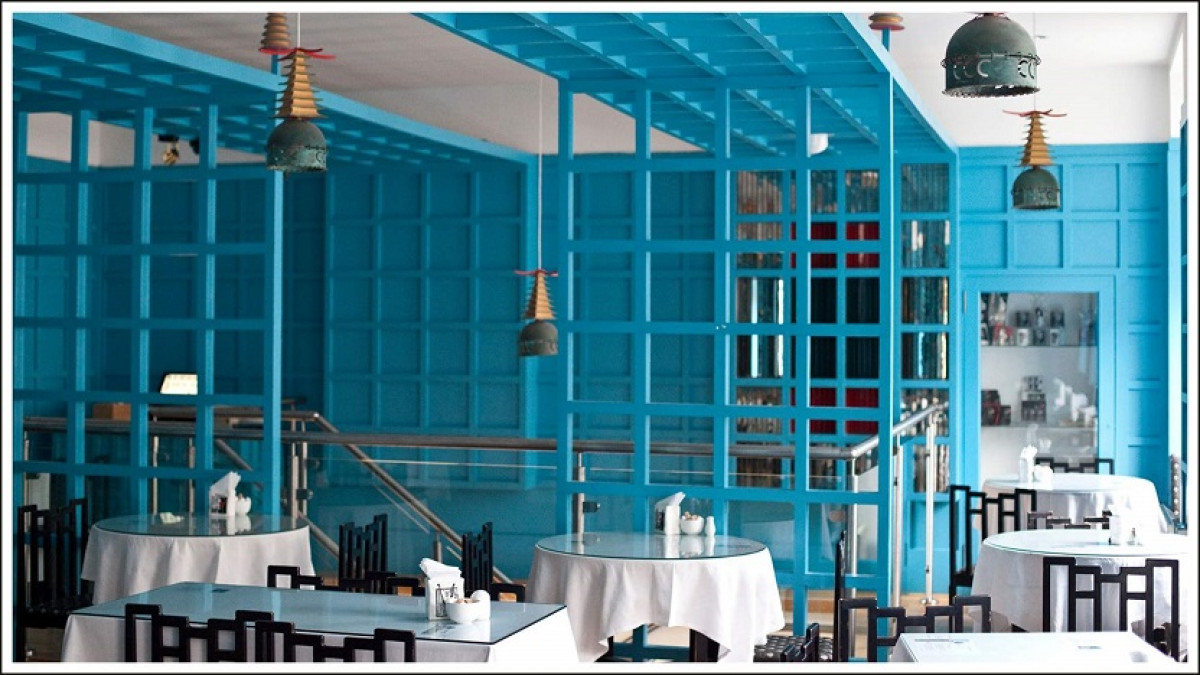

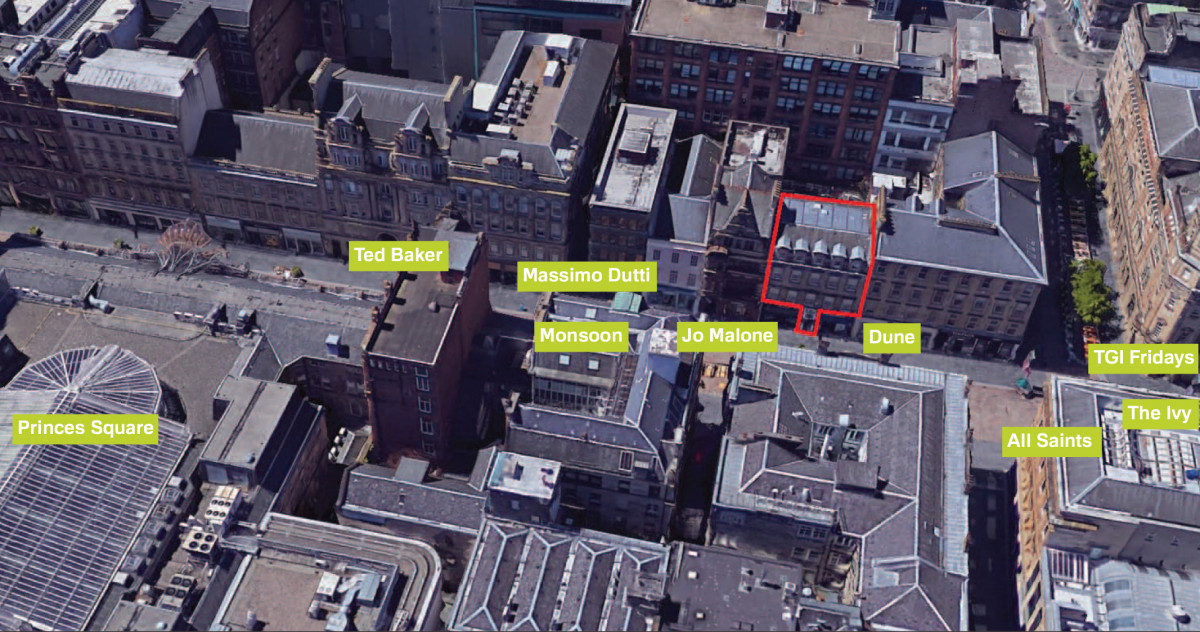

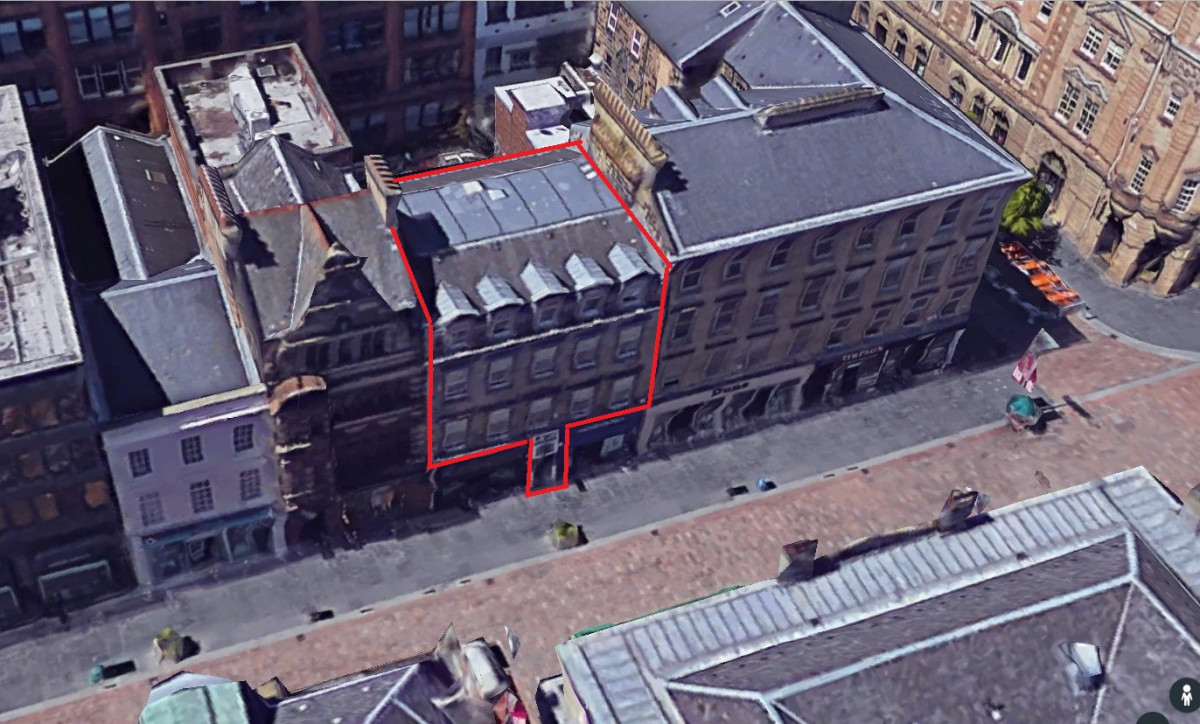

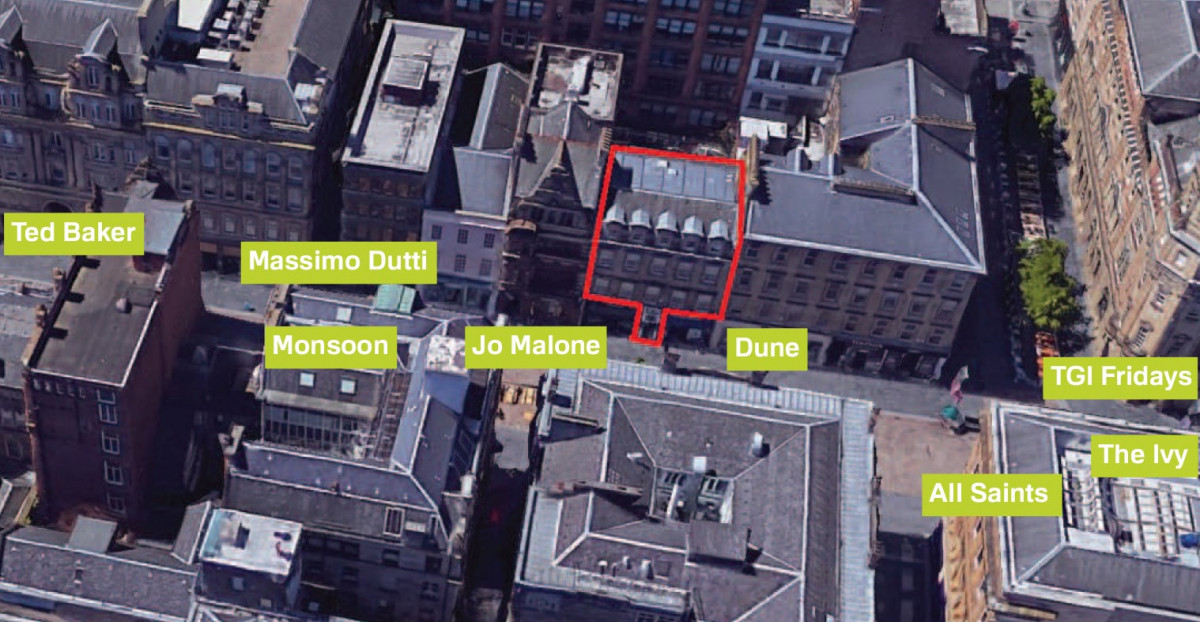

The Willow Tea Rooms are situated in a 100% prime location, with a ground floor entrance and occupying the first, second and third floors above Jo Malone and Penhaligon’s, in the heart of Buchanan Street. Surrounding occupiers include Frasers Department Store, the famous Princes Square, Massimo Dutti and TGI Fridays. The location attracts a very high footfall due to the proximity of both Glasgow Queen Street and Glasgow Central Station, along with Glasgow’s underground system. This is a rare opportunity to acquire substantial property in the core prime area of Glasgow Buchanan Street.

DESCRIPTION

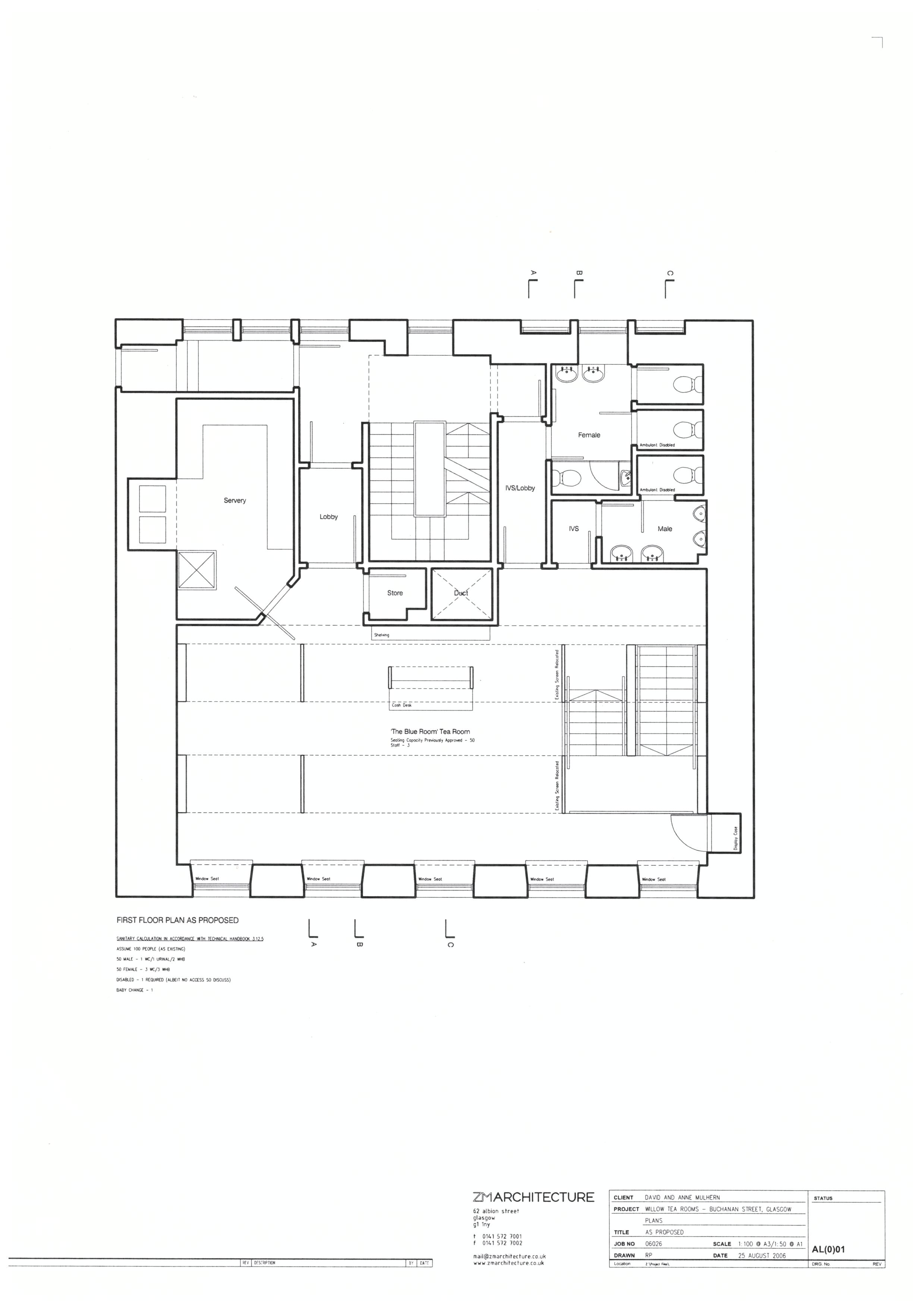

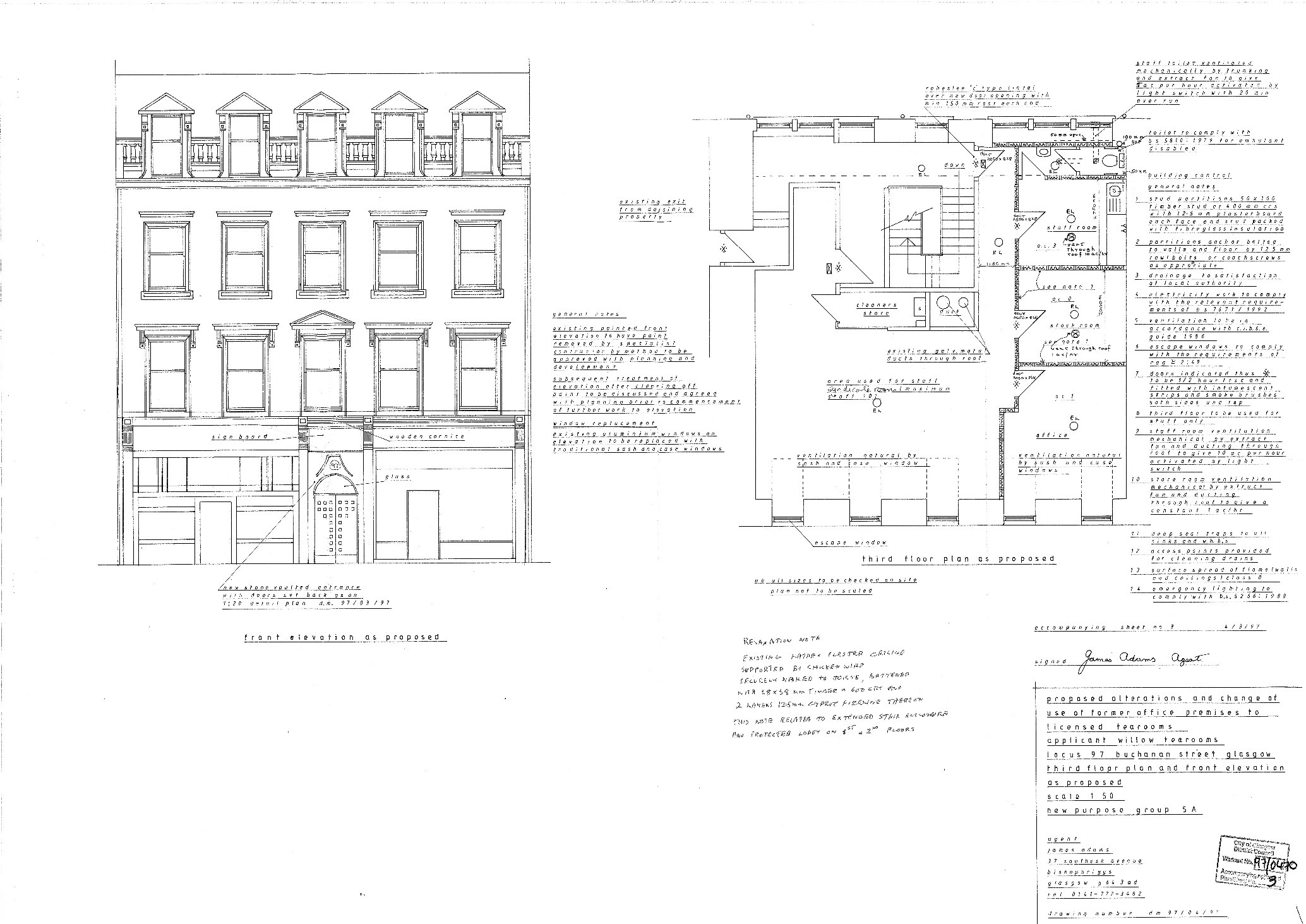

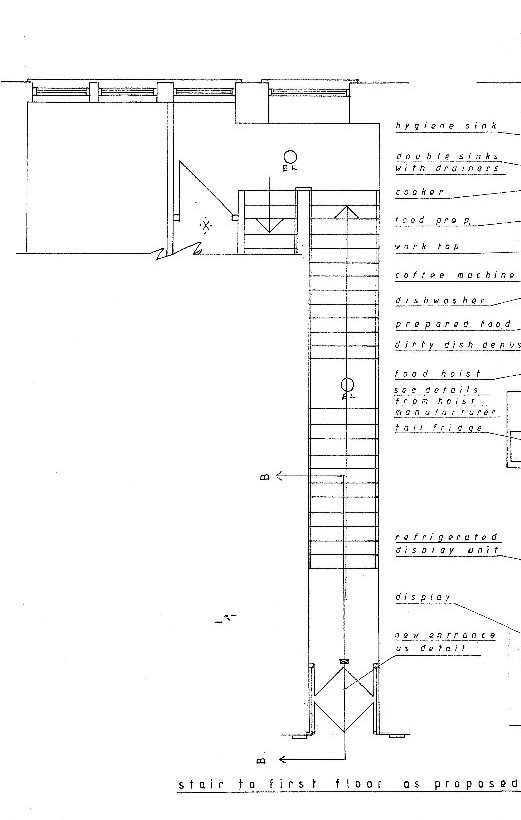

The property is accessed via an entrance directly off Buchanan Street, leading up to the first floor restaurant and retail area and, thereafter, to the second floor restaurant with offices, storage and bakery at third floor level. The building is a four-storey city centre property with prime retail at ground floor level.

ACCOMMODATION

Sq. Ft. Sq. M. Capacity Ground Floor (Entrance Only N/A N/A N/A First Floor 1,549 144 56 covers plus retail. Second Floor 1,537 143 46 covers plus toilets. Third Floor 1,485 138 Storage, staff areas and bakery Total Gross Internal Floor Area - Approximately 4,571 sq.ft. (425 sq.m.)

SERVICES

We understand the property is connected to mains water, electricity and drainage. Heating is provided from electric wall heaters and there is a electric immerser system.

RATES

Description Rateable Value Restaurant £36,250 THE LEASE & COVENANT

The lease is for a term of 15 years on a tenant full repairing and insuring basis. Rent Reviews are upwards only at 5 yearly intervals to the higher of either RPI with a minimum uplift of 5% and a maximum uplift of 15% or Market Value, whichever is the higher.

Rent Reviews upwards only 5 yearly Rent Higher of: (a) Passing Rent.

(b) Market Rent.

(c) RPI min 5% max 15% over a 5 year period.The operating business was run by our clients for around 18 years and the business was sold in 2019 after a very strong competitive bidding process to Cranachan Limited.

Tenant Covenant Tenant Cranachan Limited (SC 351052) Incorporated 2008 Net Worth £43,100 (year end Dec 2019) Cash £112,400 (year end Dec 2019) Rent Deposit (6 months rent) £32,500 Deposit held for at least 3 years, then until company profits exceed 2 times rent.

Cranachan Limited began trading in 2008. The Directors of Cranachan Limited also have other restaurant interests and have successfully run a large number of restaurants in Glasgow over many years.During the COVID19 pandemic the Landlord provided a generous support package which equated to 7.5 months entirely rent free. Full rent payment recommenced on 1st April 2021. The £32,500 rent deposit remains fully intact and will be transferred to the incoming purchaser. The package ensures the tenant is in an excellent position to capitalise on the anticipated hospitality rebound from mid 2021 assisted by the 100% rates relief and 5% VAT rate.

PRICE

Our clients are seeking offers over £849,500 plus VAT if applicable for this valuable investment property, which reflects a net initial yield of 7.26% after deduction of purchaser’s costs of 5.40%.

EPC

The property has an EPC rating of G.

Further Information

For further information, including a copy of the lease, EPC, asbestos and other reports, please contact the sole selling agent.

w: cdlh.co.uk

t: 0141 331 0650

Alan Creevy alan.creevy@cdlh.co.uk

Peter Darroch peter.darroch@cdlh.co.uk

-

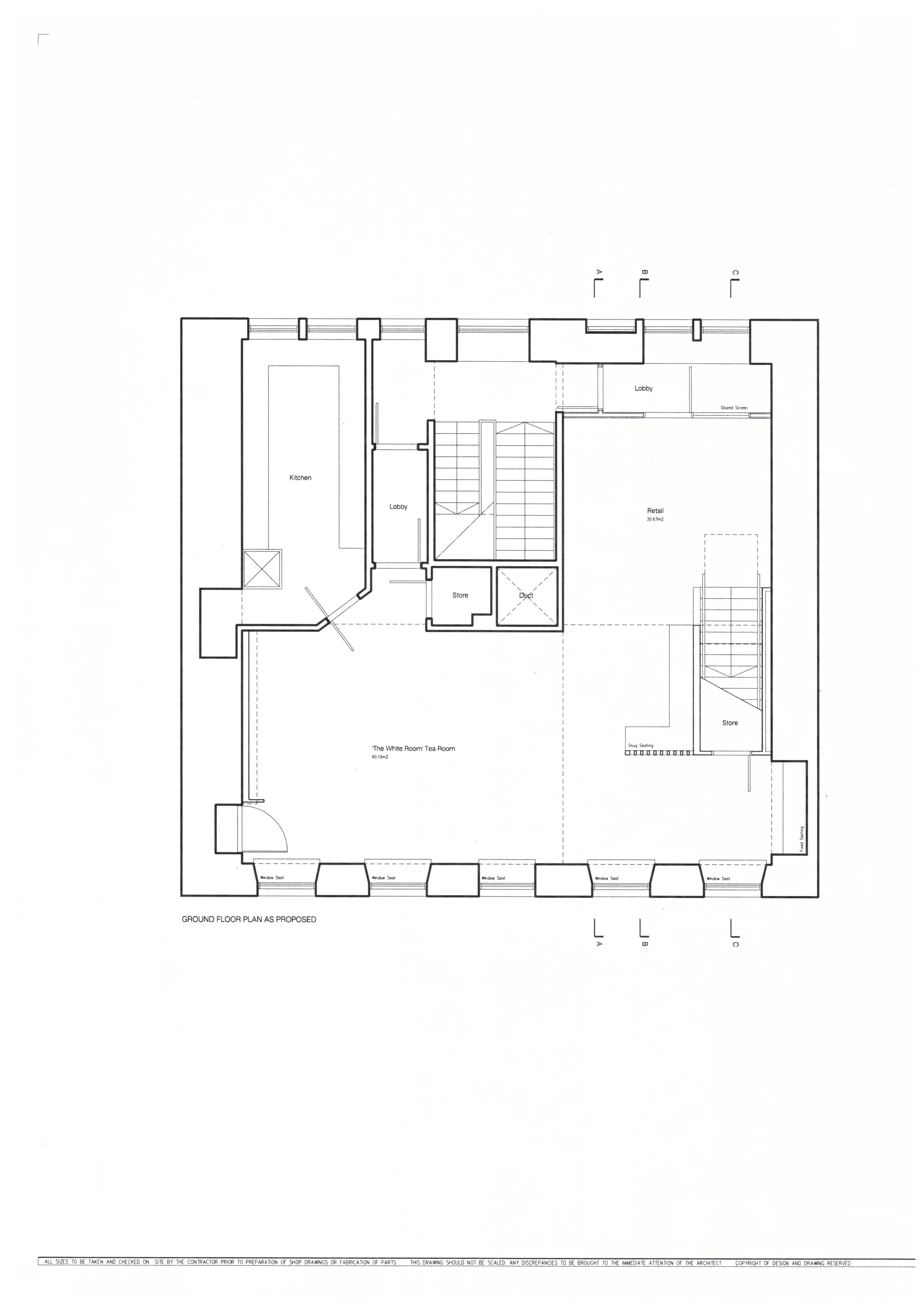

Floor Plans

-

Floor Plans - 97 Buchanan Street, Glasgow

Note the floor plans may not show the current internal layout

-

-

Dataroom

There are no property datarooms available

-

Description

UNDER OFFER

LOCATION

Glasgow is one of the strongest retail locations outside London, attracting 3.2 million visitors spending £2.3 billion, including around 800,000 international tourists (2017 figures).

The Willow Tea Rooms are situated in a 100% prime location, with a ground floor entrance and occupying the first, second and third floors above Jo Malone and Penhaligon’s, in the heart of Buchanan Street. Surrounding occupiers include Frasers Department Store, the famous Princes Square, Massimo Dutti and TGI Fridays. The location attracts a very high footfall due to the proximity of both Glasgow Queen Street and Glasgow Central Station, along with Glasgow’s underground system. This is a rare opportunity to acquire substantial property in the core prime area of Glasgow Buchanan Street.

DESCRIPTION

The property is accessed via an entrance directly off Buchanan Street, leading up to the first floor restaurant and retail area and, thereafter, to the second floor restaurant with offices, storage and bakery at third floor level. The building is a four-storey city centre property with prime retail at ground floor level.

ACCOMMODATION

Sq. Ft. Sq. M. Capacity Ground Floor (Entrance Only N/A N/A N/A First Floor 1,549 144 56 covers plus retail. Second Floor 1,537 143 46 covers plus toilets. Third Floor 1,485 138 Storage, staff areas and bakery Total Gross Internal Floor Area - Approximately 4,571 sq.ft. (425 sq.m.)

SERVICES

We understand the property is connected to mains water, electricity and drainage. Heating is provided from electric wall heaters and there is a electric immerser system.

RATES

Description Rateable Value Restaurant £36,250 THE LEASE & COVENANT

The lease is for a term of 15 years on a tenant full repairing and insuring basis. Rent Reviews are upwards only at 5 yearly intervals to the higher of either RPI with a minimum uplift of 5% and a maximum uplift of 15% or Market Value, whichever is the higher.

Rent Reviews upwards only 5 yearly Rent Higher of: (a) Passing Rent.

(b) Market Rent.

(c) RPI min 5% max 15% over a 5 year period.The operating business was run by our clients for around 18 years and the business was sold in 2019 after a very strong competitive bidding process to Cranachan Limited.

Tenant Covenant Tenant Cranachan Limited (SC 351052) Incorporated 2008 Net Worth £43,100 (year end Dec 2019) Cash £112,400 (year end Dec 2019) Rent Deposit (6 months rent) £32,500 Deposit held for at least 3 years, then until company profits exceed 2 times rent.

Cranachan Limited began trading in 2008. The Directors of Cranachan Limited also have other restaurant interests and have successfully run a large number of restaurants in Glasgow over many years.During the COVID19 pandemic the Landlord provided a generous support package which equated to 7.5 months entirely rent free. Full rent payment recommenced on 1st April 2021. The £32,500 rent deposit remains fully intact and will be transferred to the incoming purchaser. The package ensures the tenant is in an excellent position to capitalise on the anticipated hospitality rebound from mid 2021 assisted by the 100% rates relief and 5% VAT rate.

PRICE

Our clients are seeking offers over £849,500 plus VAT if applicable for this valuable investment property, which reflects a net initial yield of 7.26% after deduction of purchaser’s costs of 5.40%.

EPC

The property has an EPC rating of G.

Further Information

For further information, including a copy of the lease, EPC, asbestos and other reports, please contact the sole selling agent.

w: cdlh.co.uk

t: 0141 331 0650

Alan Creevy alan.creevy@cdlh.co.uk

Peter Darroch peter.darroch@cdlh.co.uk

-

Floor Plans

-

Floor Plans - 97 Buchanan Street, Glasgow

Note the floor plans may not show the current internal layout

-

-

Dataroom

There are no property datarooms available

Designed & built by Mucky Puddle